- February 28, 2018

- Bulletin No: 2018-04

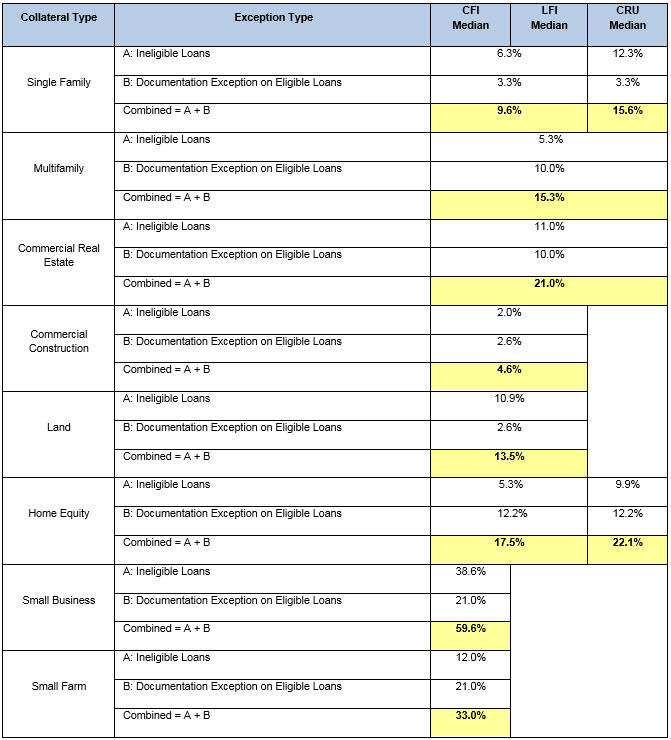

Collateral Verifications - 2018 Assigned Exception Rates

The Federal Home Loan Bank of Dallas' (Bank) collateral verification requirements, as more fully described in the Bank's Member Products and Credit Policy (MPCP), require periodic reviews of members on blanket collateral status to determine the ineligible loan and document exception rates that will be used to calculate borrowing capacity. Ineligible loan rates are determined by desktop reviews, and document exception rates are determined by onsite collateral verifications. Ineligible loan and document exception rates become outdated and are no longer valid after the end of the year following the most recent review.

For members on blanket collateral status that have never had a desktop review or onsite collateral verification, or that have outdated ineligible loan and/or document exception rates, the Bank's policy requires the application of default exception percentage rates. The exception rates are assigned based on a member's classification as either a Community Financial Institution (CFI) or Large Financial Institution (LFI) – as defined in the MPCP for banks and thrifts – or as a credit union (CRU).

Effective March 9, 2018, new members, members that have never had a desktop review or onsite collateral verification and members that had their last review prior to 2017 will be assigned the default rates set forth below. These default rates are derived from the results of all onsite and desktop reviews conducted by the Bank in 2017.

For additional information, please contact the Bank's Member Services department at 844.FHL.BANK (844.345.2265).

Sincerely,

Gustavo Molina

Senior Vice President and Chief Banking Operations Officer